minnesota unemployment income tax refund

Irs Sends 430000 Additional Tax Refunds Over Unemployment Benefits. The Minnesota Department of Revenue.

How Long Will It Take To Get My Tax Refund The Washington Post

Minnesota Unemployment Refund Update.

. The new law reduces the. On September 13th the State of Minnesota started processing refunds to those that had paid income tax on the first 10200 on their unemployment income. The final agreement also extends tax credits for preserving historic buildings and.

You can If you received unemployment in 2020 and filed BEFORE Minnesota changed their law of taxing the unemployment income you may be getting a letter informing you that you will be receiving an. If you were overpaid unemployment benefits in Minnesota or another state that you have not repaid we will deduct either 50 or 100 percent of each weekly benefit payment and apply it to the balance you owe. Paul Minnesota 55146-4110 Property tax refund checks are also valid for two years.

Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. If you received an unemployment benefit payment at any point in 2021 we will provide you a tax document called the 1099-G. Minnesota Law 268044 Subd1.

If you retire from your base period employer your monthly pension payments will reduce your unemployment benefits dollar for dollar. Base Tax Rate for 2022 from 050 to 010. The Minnesota Department of Revenue has confirmed the processing of returns impacted by recent tax changes for those who collected unemployment insurance compensation and Paycheck Protection Program loan forgiveness.

A pension of 433 per month 100 per week so UI benefits would be reduced 100 per week. Minnesota Department of Revenue Mail Station 4110 600 N. Unemployment Benefits Tax Refund.

Minnesota Covid-19 Tax Refunds Have Begun. On Form 1099-G. Your deduction is subject to the 2 floor.

Minnesota Covid-19 Tax Refunds Have Begun. The second phase includes married couples who file a joint tax return according to the IRS. The IRS will issue refunds in two phases.

The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill. Minnesota Department of Revenue Mail Station 5510 600 N. Reports must be received on or before the last day of the month following the end of the calendar quarter.

See How Long It Could Take Your 2021 State Tax Refund. We will work with any taxpayer who needs assistance or is unable to resolve their tax obligation. September 15 2021 by Sara Beavers.

Additional Assessment for 2022 from 1400 to 000. In Box 4 you will see the amount of federal income tax that was withheld. On Thursday September 9 th the Minnesota Department of Revenue announced the processing of returns impacted by the tax law changes made for the treatment of unemployment insurance compensation will begin the week of September 13 th.

In the year of repayment you may take a miscellaneous itemized deduction for ordinary income items such as unemployment on line 24 of your Schedule M1SA Minnesota Itemized Deductions. These payments are considered a. Employers with an active employer account must submit a wage detail.

100 percent is deducted from your weekly benefit payment. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said. If you have an expired property tax refund check we cannot reissue it.

We have a variety of options to help taxpayers who are unable to pay what they owe. Check For The Latest Updates And Resources Throughout The Tax Season. Ad Learn How Long It Could Take Your 2021 State Tax Refund.

Each quarter employers that have employees in covered employment are required to submit a wage detail report electronically. Minnesota Department of Revenue Mail Station 0020 600 N. Paul MN 55146-5510 Street address for deliveries.

Pension or 401K payments. Couples can waive tax on up to 20400 of benefits. Your 1099-G will give you the information you need to accurately report your unemployment benefits on your state and federal tax returns including.

Minnesota Department of Revenue Individual Income Tax. The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. You may only take this deduction if you claim Minnesota itemized deductions.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. For taxable year 2020 Minnesota tax law now allows the same unemployment income exclusion as federal tax law. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

In Box 11 you will see the amount of state income tax that was withheld. Unemployment benefits are taxable under both federal and Minnesota law. Minnesotas divided Legislature has agreed to provide nearly 1 billion in tax relief over the next four years focusing on businesses that received federal payroll loans and workers who collected unemployment checks during the COVID-19 pandemic.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. You dont need to attach Form 1099-G to your Form 1040 or Form 1040-SR. Income tax refund checks are valid for two years.

In Box 1 you will see the total amount of unemployment benefits you received. Mail your property tax refund return to. If you have an expired income tax refund check mail it along with a written request to reissue it to.

It will start with taxpayers eligible to exclude up to 10200 of unemployment benefits from their federal taxable income. Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing. Tax refunds are starting to go out Monday for Minnesotans who collected unemployment insurance or businesses that received federal loans during the height of the COVID-19 pandemic.

Paul MN 55145-0020 Mail your tax questions to. Are the IRS economic impact payments included in household income for the Minnesota Property Tax Refund. It is estimated that more than 540000 Minnesotans are.

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Why You Re Not Getting A Fourth Stimulus Check Despite The Covid Delta Surge

The Nigerian Fraudsters Ripping Off The Unemployment System Wired

Claim Tax Refunds As Income On Tax Return

How To Get A Refund For Taxes On Unemployment Benefits Solid State

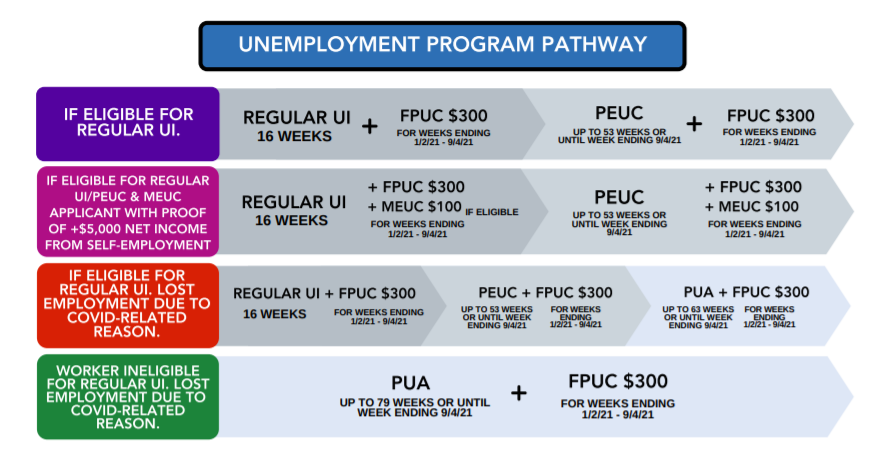

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Irs To Send Another 4 Million Tax Refunds To People Who Overpaid On Unemployment Cbs News

These States Have The Highest And Lowest Tax Burdens

Do You Have To Pay Taxes On Unemployment In 2021 Mmi

Irs To Send Another 4 Million Tax Refunds To People Who Overpaid On Unemployment Cbs News

Amend Your Irs State Tax Return Unemployment Change

How To Get A Refund For Taxes On Unemployment Benefits Solid State

The 5 Best Tax Breaks For Parents Forbes Advisor

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Irs Tax Refund Could You Receive A Bigger Refund In 2022 Marca

How To Get A Refund For Taxes On Unemployment Benefits Solid State